QUESTIONS AND ANSWERS ABOUT THIS

How do I attendSTATEMENT

solicitation of proxies by the board of directors (the “

Board”) of NextDecade Corporation (the “Company”) for the Annual Meeting of Stockholders to be held on June 3, 2024 at 9:00 a.m. Central Time and any postponement(s) or adjournment(s) thereof (the “Annual Meeting”). TheWho can vote at the Special Meeting?

Only stockholders

How many votes do I have?

As of the Record Date, there were 211,148,419257,904,371 shares of Common Stock issued and outstanding and entitled to vote at the SpecialAnnual Meeting. Holders of record of shares of Common Stock are entitled to one vote for each share of Common Stock owned by them as of the Record Date.

Ifperson or by proxy at the Annual Meeting is required for the election of directors, which means that the number of votes cast “For” a director’s election must exceed the number of votes cast “Against” such director's election. Thus, broker non-votes and abstentions will have no effect on August 1, 2023 your shares were registered directly in your name withthe election of directors.

Beneficial Owner: Shares Registered inwill be counted if you later decide not to attend the NameAnnual Meeting.

If on August 1, 2023 your shares were held, not in your name, but rather in an accountrepresented by proxy shall constitute a quorum at a brokerage firm, bank, dealermeeting of the stockholders. The person or other similar organization, then youpersons whom the Company appoints to act as inspector(s) of election will determine whether a quorum exists. Shares of Common Stock represented by properly executed and returned proxies will be treated as present. Shares of Common Stock present or represented at the Annual Meeting that abstain from voting or that are the beneficial ownersubject of shares held in “street name” and the Notice of Special Meeting of Stockholders (the “Notice”) is being forwarded to you by that organization. The organization holding your account is considered tobroker non-votes will be the stockholder of recordcounted as present for purposes of voting atdetermining a quorum.

What am I voting on?

There are two

|

|

|

|

What if another matter is properly brought before the Special Meeting?

The Board of Directors knows of no other matters that will be presented for considerationaction at the Special Meeting. If anyAnnual Meeting other matters are properly brought beforethan the meeting, it isitems described in this Proxy Statement. By signing and returning the intention ofproxy, however, you will give to the persons named inas proxies therein discretionary voting authority with respect to any other matter that may properly come before the accompanying proxyAnnual Meeting, and they intend to vote on those mattersany such other matter in accordance with their best judgment.

Who

Record holders and beneficial owners may attend the Special Meeting.

How do I vote?

You may vote “For” or “Against” the Proposals, or abstain from voting.

If you are a stockholder of record, you may vote by proxy over the telephone, vote by proxy through the Internet or vote by proxy using a proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the virtual meetingAnnual Meeting and vote electronically even ifat the Annual Meeting, which would cancel any proxy that you have already voted by proxy.

|

|

|

|

|

|

Beneficial Owner: Shares Registered in the Name of Broker or Bank

previously submitted. If you are a beneficial ownerwish to vote at the Annual Meeting but hold your shares of shares registeredCommon Stock in street name (that is, in the name of youra broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from the Company. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote by mail,institution), then you must obtainhave a valid proxy card from yourthe broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bankinstitution in order to request a proxy form.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or at the Special Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the broker or nominee may not vote your shares for the Proposals without your instructions, because the Proposals are deemed to be a “non-routine” matter by the New York Stock Exchange (“NYSE”).

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted:

|

|

|

|

If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

Annual Meeting.

What does it mean if I receive more than one Notice?

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares RegisteredStockholders in Your Name

Yes. You can revoke your proxy at any time beforeperson, you must submit it in writing to the final voteCorporate Secretary, at the meeting.above address, no later than the close of business on the tenth (10th) day following the date of the proxy statement for next year’s Annual Meeting of Stockholders to be considered timely, in accordance with the specific procedural requirements set forth in the Bylaws. If you arewould like to review the record holder of your shares, you may revoke your proxy in any oneprocedural and timing requirements relating to stockholder proposals, please contact the Corporate Secretary for a copy of the following ways:

|

|

|

|

|

|

|

|

Your most currentBylaws or view them on the SEC's website at www.sec.gov.

Beneficial Owner: Shares Registered in the Namestatement and to arrange for a proxy statement to be provided to each beneficial stockholder whose shares of Broker or Bank

If your sharesCommon Stock are held by youror in the name of a broker, bank, trust or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to approve the issuanceother nominee. Because some stockholders hold shares of Common Stock in connection with the Private Placement (as defined below), votes “For,” “Against,” abstentions and broker non-votes.

What are “broker non-votes”?

As discussed above, when a beneficial ownermultiple accounts, this process results in duplicate mailings of shares held in “street name” does not give instructionsproxy statements to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed for the Proposals to pass?

To pass, the Private Placement Proposal must receive a “For” vote from the majority of votes cast either electronically or by proxy. A majority of votes cast means the number of votes cast “For” a matter exceeds the number of votes cast “Against” such matter. If you “Abstain” from voting on the proposal, it will havestockholders who share the same effectaddress. Stockholders may avoid receiving duplicate mailings and save the Company the cost of producing and mailing duplicate documents as an “Against” vote. Broker non-votes will have no effect on the proposal. Pursuant to Nasdaq listing rules, shares issued to the Purchaser (as defined below) in the Tranche 1 Sale and Tranche 2 Sale are not entitled to vote on the Private Placement Proposal. However, should any other business come properly before the Special Meeting, the shares issued to the Purchaser in the Tranche 1 Sale and Tranche 2 Sale will be entitled to vote on any such business.

To pass, the Adjournment Proposal must receive a “For” vote from the majorityfollows:

Pursuant to voting agreements entered into with certain of our stockholders holding more than a majority of our outstandingyour shares of Common Stock entitledare registered in your own name and you are interested in consenting to vote (please see Proposal 1—The Private Placement Proposal—Voting Agreements), we expect to have sufficient votes to establish a quorum at the Special Meeting and to approve both the Private Placement Proposal and the Adjournment Proposal.

What constitutes a quorum?

Except as may be otherwise required by law, the Certificate of Incorporation or the Company’s Amended and Restated Bylaws, as amended, the holdersdelivery of a majority of the Common Stock issued and outstanding and entitled to vote and present at the Special Meeting or represented bysingle proxy shall constitute a quorum at a meeting of the stockholders. The person or persons whom the Company appoints to act as inspector(s) of election will determine whether a quorum exists. Common Stock represented by properly executed and returned proxies will be treated as present. Common Stock present or represented at the Special Meeting that abstain from voting or that are the subject of broker non-votes will be counted as present for purposes of determining a quorum. The shares issued to the Purchaser in the Tranche 1 Sale and Tranche 2 Sale will not count for purposes of determining a quorum.

How is the Purchaser’s Common Stock counted in voting on the Proposals?

The shares issued to the Purchaser in the Tranche 1 Sale and Tranche 2 Sale will not be entitled to vote on the Proposals. Moreover, the shares issued to the Purchaser in the Tranche 1 Sale and Tranche 2 Sale will not count for purposes of determining a quorum with respect to the Proposals. However, if other business comes properly before the Special Meeting, the shares issued to the Purchaser in the Tranche 1 Sale and Tranche 2 Sale will be entitled to vote on such business, and these shares will be counted in the quorum for such business.

What should I do if I have other questions?

If you have any questions or require any assistance with voting your shares,statement, you may contact the Company by mail at 1000 Louisiana Street, Suite 3900,3300, Houston, Texas 77002, by telephone at (713) 574-1880 or by e-mail at corporatesecretary@next-decade.com.

How can I find out

Preliminary voting resultsAnnual Meeting. Additionally, Timothy Wyatt, a Class B director, has a term that expires at the Annual Meeting because he was appointed to the Board on January 25, 2024 and pursuant to the Bylaws, directors appointed to fill vacancies shall hold office until the Company's next annual meeting of stockholders, which, in his case, is the Annual Meeting. If Mr. Wyatt is elected by the stockholders at the Annual Meeting, Mr. Wyatt will serve the remainder of his term as a Class B director until the 2025 Annual Meeting of Stockholders or until his successor is duly elected and qualified or until his earlier death, resignation or removal in accordance with the Bylaws.

PROPOSAL 1:APPROVE THE PRIVATE PLACEMENT

Background

| Board Diversity Matrix (As of April 18, 2024) | ||||||||||||||

| Total Number of Directors | 10 | |||||||||||||

| Female | Male | |||||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 0 | 10 | ||||||||||||

| Part II: Demographic Background | ||||||||||||||

| Asian | 0 | 1 | ||||||||||||

| White | 0 | 9 | ||||||||||||

| Name | Age | Position | ||||||||||||

| Matthew K. Schatzman | 58 | Chairman and Chief Executive Officer | ||||||||||||

| Brent E. Wahl | 54 | Chief Financial Officer | ||||||||||||

| Vera de Gyarfas | 57 | General Counsel and Corporate Secretary | ||||||||||||

| Name | Year | Salary ($) | Bonus ($) (1) | Non-equity Incentive Compensation ($) (2) | Stock Awards ($) (3) | Total ($) | |||||||||||||||||||||||||||||||||||

| Matthew K. Schatzman | 2023 | 750,000 | 805,194 | 1,787,500 | 8,244,858 | 11,587,552 | |||||||||||||||||||||||||||||||||||

| Chairman and Chief Executive Officer | 2022 | 683,333 | 850,000 | — | 9,578,906 | 11,112,239 | |||||||||||||||||||||||||||||||||||

| Brent E. Wahl | 2023 | 525,000 | 496,125 | 720,000 | 3,045,142 | 4,786,267 | |||||||||||||||||||||||||||||||||||

| Chief Financial Officer | 2022 | 441,667 | 472,500 | — | 3,345,058 | 4,259,225 | |||||||||||||||||||||||||||||||||||

| Vera de Gyarfas | 2023 | 450,000 | 354,240 | 320,000 | 1,832,186 | 2,956,426 | |||||||||||||||||||||||||||||||||||

| General Counsel and Corporate Secretary | 2022 | 416,667 | 360,000 | — | 2,145,794 | 2,922,461 | |||||||||||||||||||||||||||||||||||

| Ending Stock Price | Vesting Percentage | ||||

| $20.00 | 100% | ||||

| $17.00 | 75% | ||||

| $13.50 | 50% | ||||

| $11.00 | 25% | ||||

| Less than $11.00 | 0% | ||||

| Relative Total Shareholder Return Percentile | Vesting Percentage | ||||

| 50% Percentile or above | 100% | ||||

| 25% Percentile or above | 50% | ||||

| Below 25% Percentile | 0% | ||||

| Name | T4 PSUs | RSUs | TSR PSUs | ||||||||

| Matthew Schatzman | 707,325 | 370,675 | 370,675 | ||||||||

| Brent Wahl * | 235,775 | 123,558 | 123,558 | ||||||||

| Vera de Gyarfas | 157,183 | 82,372 | 82,372 | ||||||||

| Stock Awards | ||||||||||||||||||||||||||||||||

| Name | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($) (1) | Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested (#) | Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested ($) (1) | ||||||||||||||||||||||||||||

| Matthew K. Schatzman | 2,681,470 | (2) | 12,790,612 | 932,853 | (3) | 4,449,708 | ||||||||||||||||||||||||||

| Brent E. Wahl | 803,868 | (4) | 3,834,450 | 310,951 | (5) | 1,483,236 | ||||||||||||||||||||||||||

| Vera de Gyarfas | 547,601 | (6) | 2,612,057 | 207,300 | (7) | 988,822 | ||||||||||||||||||||||||||

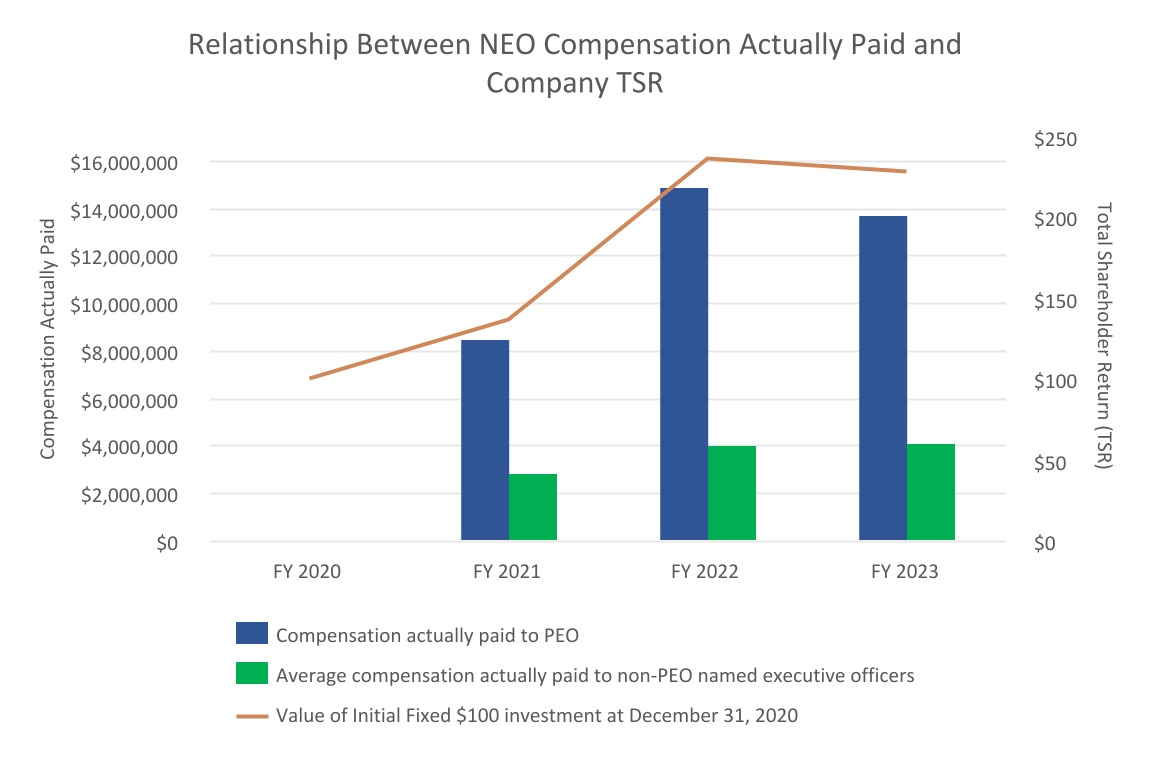

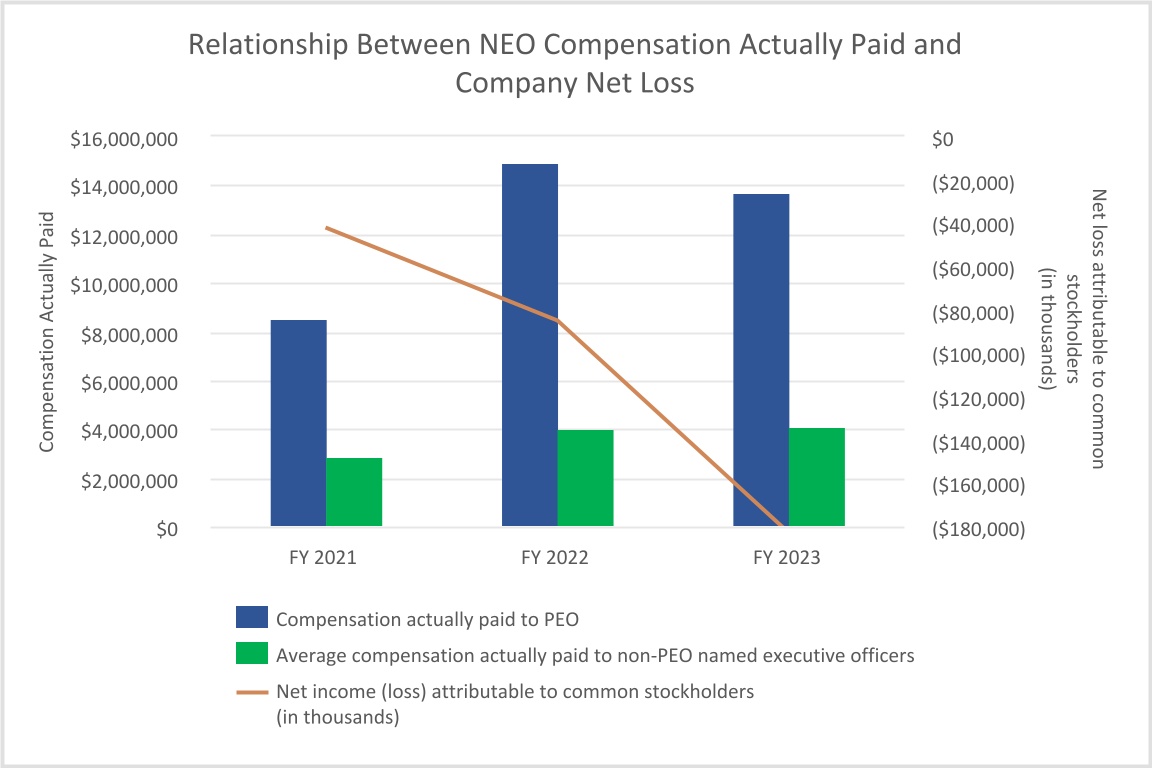

| Year | Summary compensation table total for PEO (1) | Compensation actually paid to PEO (2) (3) | Average summary compensation table total for non-PEO named executive officers (1) | Average compensation actually paid to non- PEO named executive officers (1) (2) (3) | Value of Initial Fixed $100 investment based on Total Shareholder Return (4) | Net income (loss) attributable to common stockholders (in thousands) | ||||||||||||||||||||||||||||||||

| 2023 | 11,587,552 | 13,730,640 | 3,871,347 | 4,129,041 | 228.23 | (182,745) | ||||||||||||||||||||||||||||||||

| 2022 | 11,112,239 | 14,942,672 | 3,590,843 | 4,104,788 | 236.36 | (84,353) | ||||||||||||||||||||||||||||||||

| 2021 | 9,202,686 | 8,768,254 | 3,301,344 | 3,197,972 | 136.36 | (40,396) | ||||||||||||||||||||||||||||||||

| Year | Summary compensation table total for PEO | Minus stock awards from summary compensation table | Plus year-end equity value of unvested awards granted during year | Plus change in value of unvested awards granted in prior years | Plus value of awards granted and vested during year | Plus change in value of prior year awards vested during year | Compensation actually paid to PEO | |||||||||||||||||||||||||||||||||||||

| 2023 | 11,587,552 | (8,244,858) | 6,183,657 | (491,119) | — | 4,695,409 | 13,730,640 | |||||||||||||||||||||||||||||||||||||

| 2022 | 11,112,239 | (9,578,906) | 5,722,220 | 5,771,336 | 679,106 | 1,236,677 | 14,942,672 | |||||||||||||||||||||||||||||||||||||

| 2021 | 9,202,686 | (7,851,228) | 6,786,705 | 599,920 | — | 30,171 | 8,768,254 | |||||||||||||||||||||||||||||||||||||

| Year | Average summary compensation table total for non-PEO named executive officers | Minus stock awards from summary compensation table | Plus year-end equity value of unvested awards granted during year | Plus change in value of unvested awards granted in prior years | Plus value of awards granted and vested during year | Plus change in value of prior year awards vested during year | Average compensation actually paid to non-PEO named executive officers | |||||||||||||||||||||||||||||||||||||

| 2023 | 3,871,347 | (2,438,664) | 1,717,680 | (124,672) | 148,430 | 954,921 | 4,129,041 | |||||||||||||||||||||||||||||||||||||

| 2022 | 3,590,843 | (2,745,426) | 1,527,756 | 1,274,204 | 322,935 | 134,476 | 4,104,788 | |||||||||||||||||||||||||||||||||||||

| 2021 | 3,301,344 | (2,542,010) | 2,265,038 | 75,240 | — | 98,360 | 3,197,972 | |||||||||||||||||||||||||||||||||||||

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column) | |||||||||||

| Equity Compensation Plans Approved by Security Holders | 12,795,113 | — | 2,984,752 | (1) | ||||||||||

| Equity Compensation Plans Not Approved by Security Holders | — | — | — | |||||||||||

| Total | — | |||||||||||||

| Name | Fees Earned or paid in Cash ($) | Stock Awards ($) | Total ($) | |||||||||||||||||||||||

| Brian Belke | 30,000 | (1) | 200,000 | (2) | 230,000 | |||||||||||||||||||||

| Sir Frank Chapman | 95,000 | (3) | 120,004 | (4) | 215,004 | |||||||||||||||||||||

| Thibaud de Préval | — | — | — | |||||||||||||||||||||||

| Avinash Kripalani | — | — | — | |||||||||||||||||||||||

| Seokwon Ha | — | — | — | |||||||||||||||||||||||

| Giovanni Oddo | — | — | — | |||||||||||||||||||||||

| Edward Andrew Scoggins, Jr. | — | 200,000 | (2) | 200,000 | ||||||||||||||||||||||

| William Vrattos | — | — | — | |||||||||||||||||||||||

| L. Spencer Wells | 100,000 | (5) | 120,004 | (4) | 220,004 | |||||||||||||||||||||

| Matthew Schatzman, Chairman of the Board and Chief Executive Officer | 6,555,216 | |||||||

| Brent Wahl, Chief Financial Officer | 2,020,301 | |||||||

| Vera de Gyarfas, General Counsel and Corporate Secretary | 1,103,298 | |||||||

| All current executive officers as a group | 9,678,815 | |||||||

| All current directors who are not executive officers as a group | 852,856 | |||||||

| Each nominee for election as a director | ||||||||

| Matthew Schatzman | 6,555,216 | |||||||

| Thibaud de Préval | 0 | |||||||

| Avinash Kripalani | 0 | |||||||

| William Vrattos | 0 | |||||||

| Timothy Wyatt | 0 | |||||||

| All current and former employees, including all current officers who are not executive officers, as a group | 25,692,881 | |||||||

Overview

participant to whom a nonqualified stock option is granted will not recognize income at the time of grant of such option. When such participant exercises a nonqualified stock option, the participant will recognize ordinary income equal to the excess, if any, of the fair market value as of the date of a nonqualified stock option exercise of the shares of Common Stock that the participant receives, over the option exercise price. The tax basis of such shares will be equal to the exercise price paid plus the amount includable in the participant’s gross income, and the participant’s holding period for such shares will commence on the day after which the participant recognized taxable income in respect of such shares. Subject to applicable limits of the Code and regulations thereunder, the Company will generally be entitled to a federal income tax deduction in respect of the exercise of nonqualified options in an amount equal to the ordinary income recognized by the participant. Any gain or loss recognized upon a subsequent sale or exchange of the Common Stock is treated as capital gain or loss for which the Company is not entitled to a deduction.

| Year Ended December 31, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

Audit Fees(1) | $ | 345,000 | $ | 285,000 | ||||||||||

Audit-Related Fees(2) | 415,000 | 185,000 | ||||||||||||

| Tax Fees | — | — | ||||||||||||

| Other Fees | — | — | ||||||||||||

| Total | $ | 760,000 | $ | 470,000 | ||||||||||

| Shares of common stock beneficially owned (**) | Percentage of common stock beneficially owned (%) | |||||||

| Named Executive Officers and Directors: | ||||||||

| Matthew K. Schatzman | 1,534,790 | *% | ||||||

| Brent E. Wahl | 401,186 | *% | ||||||

| Vera de Gyarfas | 165,355 | *% | ||||||

| Avinash Kripalani | — | —% | ||||||

| William Vrattos | — | —% | ||||||

| Brian Belke | 365,237 | *% | ||||||

| L. Spencer Wells | 231,425 | *% | ||||||

| Timothy Wyatt | — | —% | ||||||

| Giovanni Oddo | — | —% | ||||||

| Sir Frank Chapman | 240,442 | *% | ||||||

| Edward Andrew Scoggins, Jr. | 158,537 | *% | ||||||

| Thibaud de Préval | — | |||||||

| All directors and executive officers as a group (12 persons) | 3,096,972 | 1.2% | ||||||

| 5% Stockholders: | ||||||||

| Ninteenth Investment Company | 14,206,376 (1) | 5.5% | ||||||

| YCMGA Entities | 57,774,102 (2) | 22.4% | ||||||

| Valinor Entities | 16,527,802 (3) | 6.4% | ||||||

| Global LNG North America Corp. | 44,900,323 (4) | 17.4% | ||||||

| HGC NEXT INV LLC | 23,410,842 (5) | 9.1% | ||||||

| BlackRock, Inc. | 16,666,519 (6) | 6.5% | ||||||

The Private Placement

On June 14, 2023, we completed the

The closing of the Tranche 2 Sale was conditioned upon, among other items, the$40.0 million, (ii) promptly after conversion of the Company’s Series Athen-outstanding Convertible Preferred Stock, Series B Convertible Preferred Stock and Series C Convertible Preferred Stock (collectively, the22,072,103 shares (the “Convertible Preferred Stock”) following an FID Event (as defined under each of the Certificates of Designations for the Convertible Preferred Stock) and the Company having delivered to the Purchaser executed voting agreements among it and certain of its stockholders relating to the Tranche 3 Sale.

The FID Event occurred on July 12, 2023, as further described in the Current Report on Form 8-K filed on July 12, 2023. Following the occurrence of the FID Event, the Convertible Preferred Stock converted into approximately 59.5 million shares of Common Stock on July 26, 2023.

On July 27, 2023, we completed the

The Purchase Agreement includes customary representations, warranties$110.0 million, and covenants from the Company(iii) promptly after, and Purchaser. Pursuant to the Purchase Agreement, the Company is subject to certain interim operating covenants until the closingconditioned upon, receipt of the Tranche 3 Sale (the “Tranche 3 Closing” and, collectively with the Tranche 1 Closing and the Tranche 2 Closing, the “Closings”) that, among other things, limit the Company’s ability to incur certain future indebtedness and issue capital stock of the Company, except for the shares issued pursuant to the Purchase Agreement, subject to certain customary exceptions. Pursuant to the Purchase Agreement, the Company agreed to indemnify Purchaser and its affiliates (collectively, the “Indemnified Parties”) from and against all claims, damages, losses and expenses (including fees and disbursements of counsel) incurred by the Indemnified Parties arising out of the Purchase Agreement, except to the extent such claim, damages, loss or expense is found in a final order to have resulted from such Indemnified Party’s bad faith, actual fraud, gross negligence or willful misconduct.

The Purchase Agreement may be terminated (i) at any time by the mutual written consent of Purchaser and the Company, (ii) by either Purchaser or the Company by written notice to the other if the Tranche 3 Closing has not occurred within 180 days following June 13, 2023, except in the event that such failure to close results solely from a failure to obtain the stockholder approval of the Tranche 3 Sale, (iii) in the event that the Tranche 3 Closing has not occurred within 180 days following June 13, 2023 asCompany’s stockholders, a result of the Company’s failure to obtain the stockholder approval of the Tranche 3 Sale, by the Purchaser by written notice to the Company, and (iv) by either Purchaser or the Company in the event that a law or issuance of an injunction by a governmental body prohibits the transactions contemplated under the Purchase Agreement.

The Purchase Agreement was negotiated and entered into on an arm’s length basis with the Purchaser, which was an unaffiliated third party at that time.

We are seeking stockholder approval to issue and sell to Purchaser an additional number of shares of our CommonCompany common stock such that, following the conversion of the Convertible Preferred Stock, that,the TTE Purchaser would own, when taken together withincluding the Tranche 1 SaleShares and Tranche 2 Shares, an aggregate of 17.5% of the Company common stock then-outstanding. On June 14, 2023, the Company closed the sale of the Tranche 1 Shares, on July 26, the Company closed the sale of the Tranche 2 Sale, would result in Purchaser owning 17.5%Shares, and on September 8, 2023, the Company closed the sale of our Common Stock after giving effect thereto, for proceeds of approximately $69,399,261.77 (the “Tranche 3 Sale”). Immediately following the completion of the conversion of our Convertible Preferred Stock and the Tranche 2 Sale, there were 241,246,68714,802,055 shares of our Common Stock outstanding, and we had 660,959 restrictedcommon stock units (the “RSUs”) held by employees of the Company with expected vesting dates between the date of this Proxy Statement and the date of the Special Meeting, each of which will be settled for shares of Common Stock on a one for one basis subject to adjustments for tax withholding. Giving effect to the vesting of the RSUs, and assuming no shares are retained by the Company to satisfy tax withholding, 14,830,994 shares of Common Stock would be sold in the Tranche 3 Sale and the purchase price would be approximately $4.6793 per share.

If stockholder approval of the Tranche 3 Sale is obtained at the Special Meeting, the Tranche 3 Sale is expected to occur promptly after the Special Meeting.

THIS PROXY STATEMENT IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY ANY OF OUR SECURITIES. THE SECURITIES REFERRED TO IN THIS PROXY STATEMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS, AND MAY NOT BE OFFERED OR SOLD ABSENT SUCH REGISTRATION UNDER THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS THEREOF.

The sale and issuance of our shares of Common Stock to the Purchaser is being made in reliance on the exemption from the registration requirements of the Securities Act by virtue of Section 4(a)(2) thereof. In connection with the Purchaser’s execution of the Purchase Agreement, the Purchaser represented to us that it is either (a) a qualified institutional buyer as defined in Rule 144A of the Securities Act, (b) an institutional “accredited investor” as defined in Rule 501(a)(1), (2), (3), (7), or (8) of the Securities Act, (c) a non-U.S. person under Regulation S under the Securities Act, or (d) the foreign equivalent of (a) or (b) and that the securities purchased by it were acquired solely for its own account and for investment purposes and not with a view to the future sale or distribution.

Purchaser Rights Agreement

Right to Appoint Director. Pursuant

Board.

Other Relationships

In addition toexecution of the transactions contemplated by theStock Purchase Agreement, the Company has entered into other agreements and relationships with the Purchaser and its affiliates, as further described in the Company’s Current Report on Form 8-K, filed on July 12, 2023.

Anan affiliate of the TTE Purchaser has agreed to purchase 5.4 million tonnes per annum of LNG from the first three trains of the Rio Grande LNG Facility for 20 years on a free on board basis indexed to Henry Hub.

The Company,

Rio Grande LNG Intermediate Super Holdings, LLC, a Delaware limited liability companyCompany’s financial statements, and an indirect subsidiary of the Company (the “ND Member”) committed to make (or is deemed to have made) aggregate cash contributions of approximately $283 million, including approximately $125 million contributed prior to final investment decision, to finance a portion of the Rio Grande Facility in exchangeindependent auditors are responsible for the issuanceexamination of Class A limited liability company intereststhose statements.

The Purchaser has committed to make aggregate cash contributions of approximately $1.1 billion to JVCo, including $117 million to be funded on behalf of the ND Member. The Purchaser, together with Total Holdings (collectively, the “Contribution Support Parties”), are providing equity credit support in respect of the ND Member’s remaining committed equity contributionsmatters required to be madediscussed under applicable Public Company Accounting Oversight Board (the “

| Audit Committee of the Board of Directors, | |||||

L. Spencer Wells Avinash Kripalani Edward Andrew Scoggins, Jr. | |||||

Voting Agreements

In connection with the Purchase Agreement, priorpersons named as proxies to the Tranche 2 Sale, the Company and certain of its stockholders (the “Agreed Stockholders”) entered into voting agreements (the “Voting Agreements”). On the terms and conditions set forth in the Voting Agreements, each of the Agreed Stockholders agreed to vote (or cause to be voted) all shares of capital stock owned by such Agreed Stockholder or over which such Agreed Stockholder has voting control, (i) in favor of the Private Placement Proposal and (ii) in favor of the Adjournment Proposal.

Each Voting Agreement terminates on the earliest to occur of (i) the date of approval of each of the matters and the effecting of each of the matters and the events and transactions contemplated thereby, (ii) the termination of the Purchase Agreement in accordance with its terms, (iii) upon mutual written agreement of the parties and the Purchaser, and (iv) consummation of a merger or consolidation of the Company in accordance with the terms of the Voting Agreements.

The Agreed Stockholders collectively hold approximately 55% of our outstanding Common Stock entitled to votetheir judgment on the Proposals. Accordingly, we expect to have sufficient votes to establish a quorum at the Special Meeting and to approve both the Private Placement Proposal and the Adjournment Proposal.

Reason for Stockholder Approval

Our Common Stock is listed on The Nasdaq Capital Market, and, as such, we arethese matters, subject to the Nasdaq Marketplace Rules, including Nasdaq Listing Rule 5635. Nasdaq Listing Rule 5635(d) requires stockholder approval prior to the sale, issuance or potential issuance by the issuer of common stock (or securities convertible into exercisable common stock) equal to 20% or moredirection of the common stock or 20% or moreBoard.

Consequences if Stockholder Approval is Not Obtained

If we are unable to obtain stockholder approval, we would be unable to complete the Tranche 3 Sale and we would not receive the additional proceeds of $69,399,261.77 from the Purchaser as paymentForm 10-K for the shares of our Common Stock issued in the Tranche 3 Sale, and such funds would not be available to fund ND Member’s remaining committed equity contributions to JVCo. Without such funds, we would need to raise other capital to fund ND Member’s remaining committed equity contributions, and there can be no assurance that we will be able to raise capital from alternative sources on acceptable terms, or at all. If we are unable to raise capital from alternative sources and the equity support from the Contribution Support Parties is drawn upon, the corresponding portion of the limited liability company interests in JVCo held by ND Member would be delivered to the Contribution Support Parties, reducing our economic interests in JVCo.

Use of Proceeds

The proceeds from the Tranche 3 Sale will be used to fund the ND Member’s remaining committed equity contributions in connection with the Rio Grande Facility.

Overall Effect of the Proposal

If approved, this Private Placement Proposal would result in an increase by up to 14,830,994 shares in the number of shares of our Common Stock outstanding, and, as a result, current stockholders who do not have an opportunity to participate in the Private Placement would own a smaller percentage of our outstanding stock and, accordingly, a smaller percentage interest in the voting power, liquidation value and book value of our stock. The sale or resale of shares of our Common Stock issued pursuant to the Private Placement could cause the market price of our Common Stock to decline.

This approval would not limit our ability to engage in a public offering, as defined by Nasdaq, or to issue or sell a number of shares of our Common Stock (including shares issuable upon conversion or exercise of convertible debt, warrants or other securities exercisable for or convertible into our Common Stock) that is less than 20% of the outstanding shares on terms that might or might not be similar to those in this Private Placement Proposal.

Vote Required

The affirmative vote of a majority of votes cast, electronically or represented by proxy, is required to approve this Private Placement Proposal. Pursuant to Nasdaq listing rules, shares issued to the Purchaser in the Tranche 1 Sale and the Tranche 2 Sale are not entitled to vote on this Private Placement Proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE PRIVATE PLACEMENT PROPOSAL.

PROPOSAL 2: APPROVE THE ADJOURNMENT

Overview

The Adjournment Proposal, if approved, will allow the chair of the Special Meeting to adjourn the Special Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal will only be presented to our stockholders in the event, based on the tabulated votes, there are not sufficient votes received at the time of the Special Meeting to approve the Private Placement Proposal. In no event will the Board of Directors postpone the Special Meeting beyond the date by which it may properly do so under our bylaws and Delaware law.

Consequences if Stockholder Approval is Not Obtained

If the Adjournment Proposal is not approved by our stockholders, the chair of the Special Meeting will not adjourn the Special Meeting to a later date in the event, based on the tabulated votes, there are not sufficient votes received at the time of the Special Meeting to approve any or all of the Proposals.

Vote Required

The affirmative vote of a majority of all of the votes present or represented and entitled to vote at the Special Meeting is required to approve this Adjournment Proposal. As a result, the affirmative vote of the holders of a majority of the shares present electronically or represented by proxy who are entitled to vote and do in fact vote on the matter at the Special Meeting will be required to approve the Adjournment Proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDSA VOTE “FOR” THE ADJOURNMENT PROPOSAL

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the Record Date, there were approximately 241,246,687 shares of Common Stock outstanding. On July 26,fiscal year ended December 31, 2023 each outstanding share of our Convertible Preferred Stock converted into shares of Common Stock pursuant to their respective terms. The following table sets forth certain information regarding the ownership of our Common Stock as of the Record Date by: each person known to us to beneficially own more than 5% of our Common Stock; each director; each of our named executive officers; and all directors, director nominees and executive officers as a group. This table is based upon information supplied by officers, directors, director nominees and principal stockholders and Schedules 13D, 13F and 13G filed with the Securities and Exchange Commission (the “SEC”). The table below excludes the shares of Common Stock to be issued in the Tranche 3 Sale. Unless otherwise indicated, each person named below has an address in the care of our principal executive offices and has sole power to vote and dispose of the shares of Common Stock beneficially owned without charge by them, subject to community property laws where applicable. Amounts in the table below do not include restricted stock units that do not include the right to vote shares of Common Stock that may be delivered at settlement thereof.

Shares of Common Stock beneficially owned (**) | Percentage of Common Stock beneficially owned (%) | |||||

Named Executive Officers and Directors: | ||||||

Matthew K. Schatzman | 1,427,422 | * | % | |||

Brent E. Wahl | 373,881 | * | % | |||

Vera de Gyarfas | 142,543 | * | % | |||

Avinash Kripalani | — | — | % | |||

William Vrattos | — | — | % | |||

Brian Belke | 291,754 | * | % | |||

L. Spencer Wells | 206,868 | * | % | |||

Seokwon Ha | — | — | % | |||

Giovanni Oddo | — | — | % | |||

Sir Frank Chapman | 215,885 | * | % | |||

Edward Andrew Scoggins, Jr. | 129,068 | * | % | |||

| Thibaud de Préval(1) | — | — | % | |||

All directors, director nominees and executive officers as a group (12 persons) | 2,787,421 | 1.2 | % | |||

5% Stockholders: | ||||||

Ninteenth Investment Company | 14,206,376 | (2) | 5.9 | % | ||

YCMGA Entities | 66,136,171 | (3) | 27.4 | % | ||

Valinor Entities | 17,758,609 | (4) | 7.4 | % | ||

Bardin Hill Entities | 12,610,643 | (5) | 5.2 | % | ||

HGC NEXT INV LLC | 23,410,842 | (6) | 9.7 | % | ||

Global LNG North America Corp. | 30,098,268 | (7) | 12.5 | % | ||

BlackRock, Inc. | 14,102,952 | (8) | 5.8 | % | ||

* Indicates beneficial ownership of less than 1% of the total outstanding Common Stock.

** “Beneficial ownership” is a term broadly defined by the SEC in Rule 13d-3 under the Exchange Act and includes more than typical forms of stock ownership, that is, stock held in the person’s name. The term also includes what is referred to as “indirect ownership,” meaning ownership of shares as to which a person has or shares investment or voting power. For purposes of this table, shares of Common Stock not outstanding that are subject to options, warrants, rights or conversion privileges exercisable within 60 days of the Record Date are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. Since the Series C Warrants are not exercisable for Common Stock within 60 days of the Record Date, shares of Common Stock issuable upon such exercise are not reflected as beneficially owned by the respective principal stockholders in the table above.

(1) Following the Tranche 2 Closing, Mr. de Preval was designated for electionwriting to the Board by Global LNG North America Corp. pursuant to the Purchaser Rights Agreement and was elected to the Board on August 7, 2023.

(2) Ninteenth is a limited liability company organized under the laws of the Emirate of Abu Dhabi. Mubadala Investment Company PJSC, a public joint stock company established under the laws of the Emirate of Abu Dhabi, is the sole owner of Mamoura Diversified Global Holding PJSC, a public joint stock company established under the laws of the Emirate of Abu Dhabi, which owns 99% of Ninteenth. Accordingly, Mubadala Investment Company PJSC and Mamoura Diversified Global Holding PJSC may be deemed to have shared voting and investment power over the shares held by Ninteenth. Ninteenth’s address is Al Mamoura A, P.O. Box 45005, Abu Dhabi, United Arab Emirates.

(3) Consists of 14,424,519 shares of Common Stock held by York Credit Opportunities Investments Master Fund, L.P.; 3,796,056 shares of Common Stock held by York European Distressed Credit Fund II, L.P.; 15,030,764 shares of Common Stock held by York Multi-Strategy Master Fund, L.P.; 13,374,732 shares of Common Stock held by York Credit Opportunities Fund, L.P.; 6,850,529 shares of Common Stock held by York Capital Management, L.P.; 8,161,422 shares of Common Stock held by York Select Strategy Master Fund L.P.; 1,497,964 shares of Common Stock held by York Tactical Energy Fund, L.P.; and 3,000,185 shares of Common Stock held by York Tactical Energy Fund PIV-AN, L.P. (collectively, the “YCMGA Entities”). York Capital Management Global Advisors, LLC (“YCMGA”) is the senior managing member of the general partner of each of the YCMGA Entities. James G. Dinan is the chairman of, and controls, YCMGA. Each of YCMGA and James G. Dinan has voting and investment power with respect to the securities owned by each of the YCMGA Entities and may be deemed to be beneficial owners thereof. Each of YCMGA and James G. Dinan disclaims beneficial ownership of the reported securities except to the extent of their pecuniary interests therein. The business address of the YCMGA Entities is 767 Fifth Avenue, 17th Floor, New York, NY 10153.

(4) Consists of 13,142,013 shares of Common Stock held by Valinor Capital Partners Offshore Master Fund, L.P. (“Valinor Offshore Master”) and 4,616,596 shares of Common Stock held by Valinor Capital Partners, L.P. (“Valinor Capital” and, together with Valinor Offshore Master, the “Valinor Entities”). Valinor serves as investment manager to each of the Valinor Entities. David Gallo is the Founder, Managing Partner, and Portfolio Manager of Valinor and is the managing member of Valinor Associates, LLC (“Valinor Associates”), which serves as general partner to Valinor Capital Partners, L.P. and Valinor Capital Partners Offshore Master Fund, L.P.. Each of Valinor Management, Valinor Associates and David Gallo may be deemed to beneficially own the securities held by such fund and each of Valinor Management, Valinor Associates and David Gallo disclaims beneficial ownership of the reported securities, except to the extent of its or his pecuniary interest.

(5) Consists of 571,909 shares of Common Stock held by Bardin Hill Event-Driven Master Fund LP (“Bardin Hill Master Fund”); 6,117,325 shares of Common Stock held by HCN L.P.; 1,538,822 shares of Common Stock held by First Series of HDML Fund I LLC (“First Series HDML”); 2,641,178 shares of Common Stock held by Halcyon Mount Bonnell Fund LP (“Halcyon Mount Bonnell”); and 1,741,349 shares of Common Stock held by Halcyon Energy, Power, and Infrastructure Capital Holdings LLC (together with Bardin Hill Master Fund, HCN L.P., First Series HDML and Halcyon Mount Bonnell, the “Bardin Hill Entities”). Bardin Hill serves as the investment manager to each of the Bardin Hill Entities. Investment decisions of Bardin Hill are made by one or more of its portfolio managers, including Jason Dillow, John Greene and Pratik Desai, each of whom has individual decision-making authority. Jason Dillow is the Chief Executive Officer and Chief Investment Officer of Bardin Hill. Each of Bardin Hill, HCN GP LLC (in the case of HCN LP), Bardin Hill Fund GP LLC (in the case of Bardin Hill Event-Driven Master Fund LP, First Series of HDML Fund I LLC and Halcyon Mount Bonnell Fund LP), Jason Dillow, Kevah Konner, John Greene and Pratik Desai may be deemed to beneficially own the securities held by such Bardin Hill Entity and each of Bardin Hill, HCN GP LLC, Bardin Hill Fund GP LLC, Jason Dillow, John Greene and Pratik Desai disclaims beneficial ownership of the reported securities, except to the extent of its or his pecuniary interest. The business address of the Bardin Hill Entities is 299 Park Avenue, 24th Floor, New York, NY 10171.

(6) HGC is a Delaware limited liability company. Hanwha Impact Partners Inc. (“HIP”) is the sole member of HGC. Hanwha Impact Partners Inc. (“HIP”) is the sole member of HGC, and Hanwha Impact GlobalCorporate Secretary at NextDecade Corporation, (“HIG”) is the sole stockholder of HIP. Moonkee Yu is the President of HIG, and each of HIG and Mr. Yu may be deemed to have voting and investment power over the shares held by HGC. Mr. Yu disclaims beneficial ownership of the shares held by HGC. The address of HIG is 86, Cheonggyecheon-ro, Jung-gu, Seoul, South Korea. HGC’s address is 200 Westlake Park Blvd., Suite 1010, Houston, TX 77079.

(7) Global LNG North America Corp. is a Delaware corporation and a direct, wholly owned subsidiary of TotalEnergies Delaware, Inc. (“TotalEnergies Delaware”). TotalEnergies Delaware is a Delaware corporation and a direct, wholly owned subsidiary of TotalEnergies Holdings USA, Inc. (“TotalEnergies Holdings USA”). TotalEnergies Holdings USA is a Delaware corporation and a direct, wholly owned subsidiary of TotalEnergies Gestion USA SARL (“TotalEnergies Gestion USA”). TotalEnergies Gestion USA is a sociétéà responsabilité limitée organized under the laws of the Republic of France and a direct, wholly owned subsidiary of TotalEnergies SE. TotalEnergies SE is a European company (societas europaea or SE) organized under the laws of the Republic of France. The address of the principal office of each of TotalEnergies SE and TotalEnergies Gestion USA is 2, place Jean Millier, La Défense 6, 92400 Courbevoie, France. The address of the principal office of each of TotalEnergies Holdings USA, TotalEnergies Delaware and Global LNG North America Corp. is 1201 Louisiana St., Suite 1800, Houston, TX 77002.

(8) The registered holders of the referenced shares are the following funds and accounts under management by investment adviser subsidiaries of BlackRock, Inc.: ABR PE Investments II, LP, BOPA1, L.P., Coastline Fund, L.P., Fair Lane Investment Partners, L.P., Multi-Alternative Opportunities Fund (A), L.P., Multi-Alternative Opportunities Fund (B), L.P., Investment Partners V (A), LLC and SUNROCK DISCRETIONARY CO-INVESTMENT FUND II, LLC. BlackRock, Inc. is the ultimate parent holding company of such investment adviser entities. On behalf of such investment adviser entities, the applicable portfolio managers, as managing directors (or in other capacities) of such entities, and/or the applicable investment committee members of such funds and accounts, have voting and investment power over the shares held by the funds and accounts which are the registered holders of the reported securities. Such portfolio managers and/or investment committee members expressly disclaim beneficial ownership of the reported securities held by such funds and accounts. The address of such funds and accounts, such investment adviser subsidiaries and such portfolio managers and/or investment committee members is 55 East 52nd Street, New York, New York 10055. Shares listed in the table as beneficially owned may not incorporate all shares deemed to be beneficially held by BlackRock, Inc.

OTHER BUSINESS

As of the date of this Proxy Statement, the management of the Company has no knowledge of any business that may be presented for consideration at the Special Meeting, other than that described above. As to other business, if any, that may properly come before the Special Meeting, or any adjournment thereof, it is intended that the proxy hereby solicited will be voted in respect of such business in accordance with the best judgment of the proxy holders.

HOUSEHOLDING OF PROXY MATERIALS

Some brokers and other nominee record holders may be “householding” our proxy materials. This means a single notice and, if applicable, the proxy materials, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received. We will promptly deliver a separate copy of the notice and, if applicable, the proxy materials and our most recent annual report to stockholders to you if you write to 1000 Louisiana Street, Suite 3900,3300, Houston, Texas 77002. If you would like to receive separate notices and copies of our proxy materials and annual reports inThe Company’s Annual Report on Form 10-K for the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and telephone number.

WHERE YOU CAN FIND ADDITIONAL INFORMATION; INCORPORATION BY REFERENCE

We are subject to the informational requirements of the Exchange Act and, therefore, we file annual, quarterly and current reports, proxy statementsfiscal year ended December 31, 2023 and other information with the SEC. Our SEC filings are available to the public on the SEC’s website at www.sec.gov.

The SEC allows us to incorporate by reference the information and reports we file with it, which means that we can disclose important information to you by referring you to these documents. The information incorporated by reference is an important part of this Proxy Statement, and information that we file later with the SEC will automatically update and supersedemay also be accessed on the information already incorporated by reference. Such documents are considered to be a part of this proxy statement, effective asCompany’s website at

|

|

|

|

|

|

|

|

|

|

We will provide you without charge, upon your oral or written request, with a copy of any or all reports, proxy statements and other documents we file with the SEC (other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents). Requests for such copies should be directed to: 1000 Louisiana Street, Suite 3900, Houston, Texas 77002.

You should rely only on the information contained in this Proxy Statement, the annex attached hereto and the information incorporated by reference to vote your shares at the Special Meeting. We have not authorized anyone to provide you with information that is different from that contained in this Proxy Statement, the annex attached hereto and the information incorporated by reference.

|

ANNEX A

COMMON STOCK PURCHASE AGREEMENT

This COMMON STOCK PURCHASE AGREEMENT (this “Agreement”), dated as of June 13, 2023 (the “Effective Date”), is entered into by and between NextDecade Corporation, a Delaware corporation (“NextDecade” or the “Company”), and Global LNG North America Corp., a Delaware corporation (the “Purchaser”). NextDecade and the Purchaser are referred to herein individually as a “Party” and collectively as the “Parties.”

RECITALS:

WHEREAS, the Purchaser has indicated its interest to the Company in participating in three separate private placements (each, a “Common Stock Equity Offering”) by the Company of shares of Common Stock (as defined herein); and

WHEREAS, the Company desires to sell to the Purchaser, and the Purchaser desires to purchase from the Company, Common Stock in each Common Stock Equity Offering as more fully set forth herein.

NOW, THEREFORE, in consideration of the premises and the mutual agreements contained herein, and for other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

Section 1. DEFINITIONS. As used in this Agreement, the following terms shall have the following meanings:

“Affected Party” has the meaning assigned to it in Section 10.18(e) hereto.

“Affiliate” means, with respect to any specified Person, any other Person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such specified Person.

“Agreement” has the meaning assigned to it in the preamble hereto; it includes the Exhibits and Schedules hereto.

“Anti-Corruption Laws and Obligations” means (a) for all the Parties, the Government Rules governing the activities of the Parties, the Company, and the Transaction Documents and the Integrated Transaction Documents which prohibit bribery and corruption, as well as where applicable, the principles described in the Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, signed in Paris, France on December 17, 1997, which entered into force on February 15, 1999, and such convention’s commentaries, and/or (b) for each such Party, the Government Rules prohibiting bribery and corruption in the jurisdiction or jurisdictions in which (i) it is formed, incorporated or registered, and/or (ii) it carries out most of its business activities, and/or (iii) it is listed on a stock market, and/or (iv) the parent company of such Party is formed, incorporated or registered, carries out most of its business activities, and is listed on a stock market.

“Business Day” means any day that is not a Saturday, a Sunday or other day on which banks are required or authorized by Law to be closed in the City of New York and Paris.

“Charter Documents” means, collectively, the certificate of incorporation, articles of incorporation, bylaws, certificate of designations or board resolutions establishing the terms of any security, certificate of formation, operating agreement, limited liability company agreement and similar formation or organizational documents of any entity.

“Closings” has the meaning assigned to it in Section 2.3 hereto.

“Closing Date” has the meaning assigned to it in Section 2.3 hereto.

“Code” means the Internal Revenue Code of 1986.

“Common Stock” means the common stock of the Company, $0.0001 par value.

“Common Stock Equity Offering” has the meaning assigned to it in the Recitals hereto.

“Company” has the meaning assigned to it in the preamble hereto.

“Company Benefit2017 Omnibus Incentive Plan,” means each (i) “employee benefit plan” within the meaning of Section 3(3) of ERISA, (ii) other benefit and compensation plan, contract, policy, program, practice, arrangement or agreement, including, but not limited to, pension, profit-sharing, savings, termination, executive compensation, phantom stock, change-in-control, retention, salary continuation, vacation, sick leave, disability, death benefit, insurance, hospitalization, medical, dental, life (including all individual life insurance policies as to which the Company or its Subsidiaries are the owners, the beneficiaries, or both), employee loan, educational assistance, fringe benefit, deferred compensation, retirement or post-retirement, severance, equity or equity-based, incentive and bonus plan, contract, policy, program, practice, arrangement or agreement, and (iii) other employment, consulting or other individual agreement, plan, practice, policy, contract, program, and arrangement, in each case, (x) which is sponsored or maintained by the Company or any of its ERISA Affiliates in respect of any current or former employees, directors, independent contractors, consultants or leased employees of the Company or any of its Subsidiaries or (y) with respect to which the Company or any of its Subsidiaries has any actual or potential liability.

“Company IRS Form” has the meaning assigned to it in Section 2.4(i) hereto.

“Competition Laws” means the antitrust or competition laws in effect and applicable with respect to the transactions contemplated by the Transaction Documents, including in the European Union and the United States of America.

“Control” (including the terms “control”, “controlling”, “controlled by” and “under common control with”), with respect to the relationship between or among two or more Persons, means the possession, directly or indirectly or as trustee, personal representative or executor, of the power to direct or cause the direction of the affairs, policies or management of a Person, whether through the ownership of voting securities, as trustee, personal representative or executor, by contract, credit arrangement or otherwise.

“Conversion Completion Date” means the Business Day following the later of (i) conversion of all shares of the Company’s outstanding preferred stock into Common Stock in accordance with the terms thereof and (ii) the FID Event.

“Dispute” has the meaning assigned to it in Section 10.13(a) hereto.

“Dispute Notice” has the meaning assigned to it in Section 10.13(a) hereto.

“Effective Date” has the meaning assigned to it in the preamble hereto.

“Encumbrance” means any security interest, pledge, mortgage, lien, claim, option, charge, restriction or encumbrance.

“Environmental Claim” means any claim, action, cause of action, suit, proceeding, investigation, Order, demand or notice by any Person alleging liability (including liability for investigatory costs, cleanup costs, governmental response costs, natural resources damages, property damages, personal injuries, attorneys’ fees, consultants’ fees, fines or penalties) arising out of, based on, resulting from or relating to (a) the presence or Release of, or exposure to, any Hazardous Materials; (b) circumstances forming the basis of any violation, or alleged violation, of any Environmental Law; or (c) any other matters covered or regulated by, or for which liability is imposed under, Environmental Laws.

“Environmental Laws” means all applicable Laws relating to pollution, the protection, restoration or remediation of or prevention of harm to the environment or natural resources (including plant and animal species), or the protection of human health and safety, including Laws relating to: (i) the exposure to, or Releases or threatened Releases of, Hazardous Materials; (ii) the generation, manufacture, processing, distribution, use, treatment, containment, disposal, storage, transport or handling of Hazardous Materials; or (iii) recordkeeping, notification, disclosure and reporting requirements respecting Hazardous Materials.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” means any Person (whether or not incorporated) that together with the Company or any of its Subsidiaries is treated as a single employer within the meaning of Section 414 of the Code.

“Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time and the rules and regulations promulgated thereunder, or any successor statute.

“FID Event” means (i) the issuance of the notice to proceed in accordance with the engineering, procurement and construction contract for the Terminal with all conditions precedent thereunder for the issuance of such notice to proceed having been satisfied, and (ii) the procurement of all necessary debt or equity financing arrangements to engineer, procure and construct the Terminal under said agreement, with all conditions precedent thereunder for initial draw of funds having been satisfied.

“First Closing” has the meaning assigned to it in Section 2.3 hereto.

“First Closing Date” has the meaning assigned to it in Section 2.3 hereto.

“First Purchase Price” has the meaning assigned to it in Section 2.2 hereto.

“Fundamental Representations” means (i) with respect to the Company, those representations and warranties of the Company set forth in Sections 5.2 (Organization and Qualification; Subsidiaries), 5.3 (Authorization; Enforcement; Validity), 5.4 (No Conflicts), 5.5 (Consents and Approvals), 5.6 (Capitalization) and 5.7 (Valid Issuance), and (ii) with respect to the Purchaser, those representations and warranties of the Purchaser set forth in Sections 6.1 (Organization and Qualification), 6.2 (Authorization; Enforcement; Validity), 6.3 (No Conflicts) and 6.4 (Consents and Approvals).

“Good Standing Certificate” has the meaning assigned to it in Section 2.4(d) hereto.

“Governmental Authority” means any federal, national, supranational, tribal, foreign, state, provincial, local, county, municipal or other government, any political subdivision of the foregoing, any governmental, regulatory or administrative authority, agency, department, bureau, board, commission or official or any quasi-governmental or private body exercising any regulatory, taxing, importing or other governmental or quasi-governmental authority, or any court, tribunal, judicial or arbitral body, or any Self-Regulatory Organization.

“Government Rule” means any statute, law, regulation, ordinance, rule, judgment, order, decree, permit, concession, grant, franchise, license, agreement, directive, requirement, or other governmental restriction or any similar form of decision or determination by or any binding interpretation or administration of any of the foregoing, in each case, having the force of law by, any Governmental Authority, which is applicable to any Person, whether now or hereafter in effective.

“Hazardous Materials” means: (a) any hazardous materials, hazardous wastes, hazardous substances, toxic wastes, solid wastes, and toxic substances as those or similar terms are defined under any Environmental Laws; (b) any asbestos or asbestos containing material; (c) polychlorinated biphenyls (“PCBs”), or PCB containing materials or fluids; (d) radon; (e) any petroleum, petroleum hydrocarbons, petroleum products, crude oil and any fractions or derivatives thereof; (f) per- and polyfluoroalkyl substances and other emerging contaminants, and (g) any other substance, material, chemical, waste, pollutant, or contaminant that, whether by its nature or its use, or exposure to is subject to regulation or could give rise to liability under any Laws relating to pollution, waste, human health and safety, or the environment.

“ICC Arbitration Rules” has the meaning assigned to it in Section 10.13(b) hereto.

“Indemnified Party” means the Purchaser, its Affiliates, and each of their respective directors, managers, portfolio managers, investment advisors, officers, principals, partners, members, equity holders (regardless of whether such interests are held directly or indirectly), trustees, controlling persons, predecessors, successors and assigns, Subsidiaries, employees, agents, advisors, attorneys and representatives.

“Insolvency Event” means, with respect to any Person, the occurrence of any of the following:

(a) such Person shall (A) (i) voluntarily commence any proceeding or file any petition seeking relief under Title 11 of the United States Code, Sections 101 et. seq. (the “Bankruptcy Code”) or any other federal, state or foreign bankruptcy, insolvency, liquidation or similar Law, (ii) consent to the institution of, or fail to contravene in a timely and appropriate manner, any such proceeding or the filing of any such petition, (iii) apply for or consent to the appointment of a receiver, trustee, custodian, sequestrator or similar official for such Person or for a substantial part of its property or assets, (iv) file an answer admitting the material allegations of a petition filed against it in any such proceeding, (v) make a general assignment for the benefit of creditors or (vi) take any action for the purpose of effecting any of the foregoing or (B) such Person shall become unable, admit in writing its inability or fail generally to pay its debts as they become due; or

(b) an involuntary proceeding shall be commenced or an involuntary petition shall be filed seeking (A) relief in respect of such Person or of a substantial part of the property or assets of such Person, under the Bankruptcy Code or any other federal, state or foreign bankruptcy, insolvency, receivership or similar Law, (B) the appointment of a receiver, trustee, custodian, sequestrator or similar official for such Person or for a substantial part of the property of such Person or (C) the winding-up or liquidation of such Person; and such proceeding or petition shall continue undismissed for sixty (60) days or an order or decree approving or ordering any of the foregoing shall have been entered.

“Integrated Transaction Documents” means (i) that certain Liquefied Natural Gas Sale and Purchase Agreement, by and between Rio Grande LNG, LLC and TotalEnergies Gas & Power North America, Inc. and (ii) that certain Subscription Agreement, to be entered into by and among Purchaser, the Company, NextDecade LNG, LLC, Rio Grande LNG Intermediate Super Holdings LLC and Rio Grande LNG Intermediate Holdings, LLC in connection with the FID Event.

“Intellectual Property” means the following intellectual property rights, both statutory and common law rights, if applicable: (a) copyrights and registrations and applications for registration thereof, (b) trademarks, service marks, trade names, slogans, domain names, logos, trade dress, and registrations and applications for registrations thereof, (c) patents, as well as any reissued and reexamined patents and extensions thereto, and any patent applications, continuations, continuations in part and divisional applications and patents issuing therefrom, and (d) trade secrets and confidential information, including ideas, designs, concepts, compilations of information, methods, techniques, procedures, processes and other know-how, whether or not patentable.

“Investment Company Act” has the meaning assigned to it in Section 5.21 hereto.

“Knowledge” means with respect to the Company, the actual knowledge after due inquiry of the persons set forth on Schedule 1.1(a).

“Law” means any applicable federal, national, supranational, foreign, state, provincial, local, county, municipal or similar statute, law, common law, guideline, policy, ordinance, regulation, rule, code, constitution, treaty, requirement, judgment or judicial or administrative doctrines enacted, promulgated, issued, enforced or entered by any Governmental Authority, including any applicable Competition Laws.

“Material Adverse Effect” means any effect, change, event, occurrence, development, or state of facts that, individually or in the aggregate with all other such effects, changes, events, occurrences, developments, or states of fact, (A) has had, or would reasonably be expected to have, a material adverse effect on the business, assets, liabilities, condition (financial or otherwise), or results of operations of the Company and its Subsidiaries, taken as a whole, or (B) would, or would reasonably be expected to, prevent or materially impair the ability of the Company to consummate the transactions contemplated by this Agreement, but expressly excluding in the case of the foregoing clause (A) any such effect, change, event, occurrence, development, or state of facts, either alone or in combination, to the extent arising out of or resulting from:

(a) the execution or delivery of this Agreement, the consummation of the transactions contemplated by this Agreement or the public announcement or other publicity with respect to any of the foregoing; provided, however, that the exception set forth in this clause (a) shall not apply to the representations and warranties of Section 5.4 or to the representations and warranties set forth in Section 5.5;

(b) general economic conditions (or changes in such conditions) in the United States or conditions in the global economy generally that do not affect the Company and its Subsidiaries, taken as a whole, disproportionately as compared to other similarly situated participants in the liquefied natural gas export industry (in which case only such disproportionate impact shall be considered);

(c) any acts of terrorism, sabotage, war, the outbreak or escalation of hostilities, weather conditions, change in geopolitical conditions, public health event, pandemic (including COVID-19), epidemic, disease outbreak or other force majeure events, in each case, including any worsening thereof that do not affect the Company and its Subsidiaries, taken as a whole, disproportionately as compared to other similarly situated participants in the liquefied natural gas export industry (in which case only such disproportionate impact shall be considered);

(d) changes in the trading price or trading volume of the Common Stock;

(e) conditions (or changes in such conditions) generally affecting the liquefied natural gas export industry that do not affect the Company and its Subsidiaries, taken as a whole, disproportionately as compared to other similarly situated participants in the liquefied natural gas export industry (in which case only such disproportionate impact shall be considered);

(f) conditions (or changes in such conditions) in the financial markets, credit markets or capital markets in the United States or any other country or region, including (i) changes in interest rates in the United States or any other country and changes in exchange rates for the currencies of any countries or (ii) any suspension of trading in securities (whether equity, debt, derivative or hybrid securities) generally (other than a suspension of the trading of the Company’s Common Stock, which constitutes a Material Adverse Effect, provided such suspension is not part of a broader suspension of securities) on any securities exchange or over-the-counter market operating in the United States or any other country or region in each case, that do not affect the Company as a whole disproportionately as compared to other similarly situated participants in the liquefied natural gas export industry (in which case only such disproportionate impact shall be considered); or

(g) any changes in any Laws or any accounting regulations or principles that do not affect the Company, taken as a whole, disproportionately as compared to other similarly situated participants in the liquefied natural gas export industry (in which case only such disproportionate impact shall be considered).

Notwithstanding any provision of the preceding sentence to the contrary, (i) the occurrence of an Insolvency Event in respect of the Company or any Subsidiary of the Company shall be deemed to constitute a Material Adverse Effect and (ii) any material breach of any Voting Agreement by any party thereto shall be deemed to constitute a Material Adverse Effect.

“Material Contracts” means all “material contracts” of the Company within the meaning of Item 601 of Regulation S-K of the SEC.

“NASDAQ” means The Nasdaq Stock Market LLC.

“NextDecade” has the meaning assigned to it in the preamble hereto.

“OFAC” means the Office of Foreign Assets Control of the U.S. Department of the Treasury.

“Officer’s Certificate” has the meaning assigned to it in Section 2.4(j) hereto.

“Opinion” has the meaning assigned to it in Section 2.4(f) hereto.

“Order” means any order, writ, judgment, injunction, decree, ruling, directive, stipulation, determination or award made, issued or entered by or with any Governmental Authority, whether preliminary, interlocutory or final.

“Party” or “Parties” has the meaning assigned to it in the preamble hereto.

“Permits” means all permits, consents, approvals, registrations, licenses, authorizations, qualifications and filings with and under all federal, state, local or foreign Laws and Governmental Authorities.

“Person” means any individual, partnership, firm, corporation, limited liability company, association, joint venture, trust, Governmental Authority, unincorporated organization or other entity, as well as any syndicate or group that would be deemed to be a person under Section 13(d)(3) of the Exchange Act.

“Proxy Statement” has the meaning assigned to it in Section 8.5 hereto.

“Public Official” means (a) an elected or appointed official, and/or (b) any Person employed or used as an agent of any Governmental Authority or any company in which a Governmental Authority owns, directly or indirectly, a majority or other Controlling interest, and/or (c) an official of a political party, and/or (d) a candidate for public office, and/or (e) any official, employee or agent of any public international organization.

“Purchase Price” has the meaning assigned to it in Section 2.2 hereto.

“Purchaser” has the meaning assigned to it in the preamble hereto.

“Purchaser Material Adverse Effect” means any event, circumstance, development, change or effect that, individually or in the aggregate, does or would reasonably be expected to prevent, materially delay or materially impair the ability of the Purchaser to consummate the transactions contemplated hereby.

“Purchaser Rights Agreement” means the Purchaser Rights Agreement, in substantially the form attached hereto as Exhibit B.

“Registration Rights Agreement” means the Registration Rights Agreement, in substantially the form attached hereto as Exhibit A.

“Release” means any release, spill, emission, discharge, leaking, pouring, dumping, emptying, pumping, injection, deposit, disposal, dispersal, leaching or migration into the indoor or outdoor environment (including soil, sediment, ambient air, surface water, groundwater and surface or subsurface strata) or into or out of any property, including the movement of Hazardous Materials through or in the air, soil, surface water, groundwater or property.

“Sanctions Authority” means the United Nations Security Council and any Governmental Authority of the United States of America, the European Union, the Republic of France or the United Kingdom charged with the enactment, administration, implementation and enforcement of Sanctions.

“Sanctioned Person” means any Person that is the target of Sanctions, including, (a) any Person listed in any Sanctions related list of designated Persons maintained by OFAC or the U.S. Department of State, by the United Nations Security Council, the European Union or His Majesty’s Treasury of the United Kingdom, (b) any Person located, organized or ordinarily resident in a Sanctioned Territory, or (c) any Person directly or indirectly owned or controlled by any such Person or Persons described in the foregoing clauses (a) and (b).

“Sanctioned Territory” means a country or territory that is the subject or target of comprehensive Sanctions, currently Cuba, Iran, North Korea, Syria, the Crimea region of Ukraine and the so-called Donetsk People’s Republic or so-called Luhansk People’s Republic.

“Sanctions” means economic, financial or trade sanctions Government Rules, including any embargoes or other restrictive measures enacted, imposed, administered, implemented or enforced from time to time by any Sanctions Authority.

“SEC” has the meaning assigned to it in Section 5.8(a) hereto.

“Second Closing” has the meaning assigned to it in Section 2.3 hereto.

“Second Closing Date” has the meaning assigned to it in Section 2.3 hereto.

“Second Purchase Price” has the meaning assigned to it in Section 2.2 hereto.

“SEC Reports” has the meaning assigned to it in Section 5.8(a) hereto.

“Secretary’s Certificate” has the meaning assigned to it in Section 2.4(e) hereto.

“Securities Act” means the Securities Act of 1933, as amended from time to time, and the rules and regulations promulgated thereunder, or any successor statute.

“Self-Regulatory Organization” means any securities exchange, futures exchange, contract market, any other exchange or corporation or similar self-regulatory body or organization applicable to a Party to this Agreement, including, for the avoidance of doubt, the Financial Industry Regulatory Authority.

“Shares” means the shares of Common Stock to be issued and sold to Purchaser at one or more respective Closings.

“Stockholder Approval” has the meaning assigned to it in Section 4.1 hereto.

“Stockholder Approval Deadline” has the meaning assigned to it in Section 8.5 hereto.

“Stockholder Condition Date” means the date of a meeting of the Company’s stockholders at which the Stockholder Approval is received.

“Stockholder Meeting” has the meaning assigned to it in Section 8.5 hereto.

“Subsidiary” means, with respect to any Person, any other Person of which the first Person owns, directly or indirectly, securities or other ownership interests having voting power to elect a majority of the board of directors or other Persons performing similar functions for such Person (or, if there are no such voting interests, more than 50% of the equity interests allowing for effective control of the second Person).

“Survival Period” has the meaning assigned to it in Section 10.3 hereto.

“Tax” (and, with correlative meaning, “Taxes” and “Taxable”) means: any taxes, customs, duties, charges, fees, levies, penalties or other assessments, fees and other governmental charges imposed by any Governmental Authority, including income, profits, gross receipts, net proceeds, windfall profit, severance, property, personal property (tangible and intangible), production, sales, use, leasing or lease, license, excise, duty, franchise, capital stock, net worth, employment, occupation, payroll, withholding, social security (or similar), unemployment, disability, payroll, fuel, excess profits, occupational, premium, severance, estimated, alternative or add-on minimum, ad valorem, value added, turnover, transfer, stamp or environmental tax, or any other tax, custom, duty, fee, levy or other like assessment or charge of any kind whatsoever, together with any interest, penalty, addition to tax, or additional amount attributable thereto.

“Tax Representations” means those representations and warranties of the Company set forth in Section 5.20 hereto.

“Tax Returns” means any return, report, statement, information return or other document (including any amendments thereto and any related or supporting information) filed or required to be filed with any Governmental Authority in connection with the determination, assessment, collection or administration of any Taxes or the administration of any laws, regulations or administrative requirements relating to any Taxes.

“Terminal” means two or more liquefaction trains at the Rio Grande LNG terminal facility at the Port of Brownsville in southern Texas.

“Third Closing” has the meaning assigned to it in Section 2.3 hereto.

“Third Closing Date” has the meaning assigned to it in Section 2.3 hereto.